Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. The County sales tax rate is.

Irvine Approves New Middle Income Housing Projects Giving Up Millions In Tax Revenue

The Irvine sales tax rate is.

. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. 100 US Average. State income tax rate highest bracket 9.

- The Income Tax Rate for Irvine is 93. The us average is 46. A combined city and county sales tax rate of 175 on top of Californias 6 base makes Irvine one of the more expensive cities to shop in with 1117.

Other Taxes Particular to City - Utility User Tax UUT on intrastate telephone use all electricity and gas on commercial - 15. And its top marginal income tax rate of 123 is the highest state income tax rate in the country. The combined rate used in this calculator 775 is the result of the california state rate 6 the 92618.

What is the sales tax rate in Irvine California. The average Income Tax Auditor salary in Irvine California is 69059 as of November 29 2021 but the salary range typically falls between 58266 and 81048. The 92618 Irvine California general sales tax rate is 775.

The combined Irvine sales tax is 775. Find a local Irvine California Income Tax attorney near you. Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million.

This rate includes any state county city and local sales taxes. 074 of home value. There is an additional 1 tax on taxable income over 1 million for mental health services.

Irvine Income Tax Rate. Everything from groceries gas prices. 930 the total of all income taxes for an area including state county and local taxes.

This is the total of state county and city sales tax rates. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

- Tax Rates can have a big impact when Comparing Cost of Living. The median property tax in California is 283900 per year for a home worth the median value of 38420000. Sales Tax in Irvine CA.

The latest sales tax rate for Irvine CA. The US average is 46. Wayfair Inc affect California.

Irvine Sales Tax Rate. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. Income and Salaries for Irvine - The average income of a Irvine resident is 43456 a year.

The California sales tax rate is currently. But prices in Irvine have held up better than those elsewhere in Orange County and foreclosures arent nearly as widespread. And its top marginal income tax rate of 123 is the highest state income tax rate in the country.

Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. The US average is.

The average household income in Irvine CA is 91999 and a single resident has an average income of 43456. 930 The total of all income taxes for an area including state county and local taxesFederal income taxes. Tax Rates for Irvine CA.

This includes the following. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Expect to pay between 1715 in rent for a studio or 3672 for a 4-bedroom.

Tax amount varies by county. The minimum combined 2022 sales tax rate for Irvine California is. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA.

The property tax rate is higher than the average property tax rate in California which is 073. Orange County sales tax. About our Cost of Living Index.

The combined rate used in this calculator 775 is the result of the California state rate 6 the 92618s county rate 025 and in some case special rate 15. Irvine Hotel Improvement District Assessment Tax - 2. California state sales tax.

Did South Dakota v. The state of Californias income tax rate is 1 to 123 the highest in the US. Above 100 means more expensive.

725 for State Sales and Use Tax. - The Median household income of a Irvine resident is 91999 a year. Taxes in Irvine California are 102 more expensive than Brea California.

The US average is 28555 a year. Below 100 means cheaper than the US average. 2020 rates included for use while preparing your income tax deduction.

775 The total of all sales taxes for an area including state county and local taxesIncome Taxes. Transient Occupancy Tax TOT - 8. This is similar to the federal income tax system.

Irvine Ca Cost Of Living Is Irvine Affordable Data Tips Info

Calif Business Owners Pay Highest Income Tax Rate Orange County Register

How Good Is 85k Salary In Irvine California For A Family Quora

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Why Households Need 300 000 To Live A Middle Class Lifestyle

Medical Orthopedic Surgeon Salary In Irvine Ca Comparably

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Why Households Need 300 000 To Live A Middle Class Lifestyle

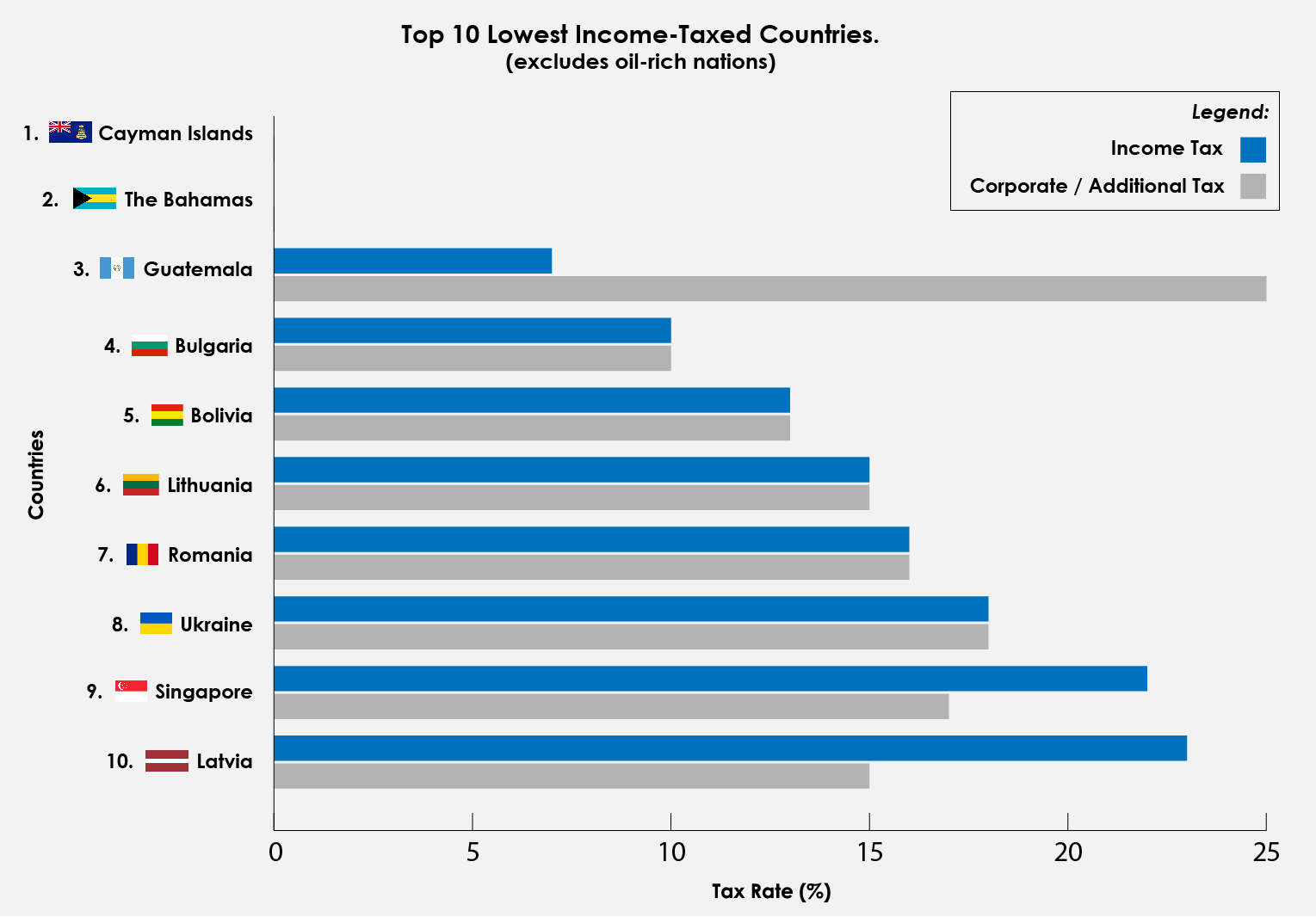

Does Lower Income Tax Make A Happier Country

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Irvine Forgoes Property Taxes To Convert 1 000 Plus Units To Middle Income Housing Orange County Register

2017 California Income Tax What You Need To Know The Motley Fool

How Good Is 85k Salary In Irvine California For A Family Quora

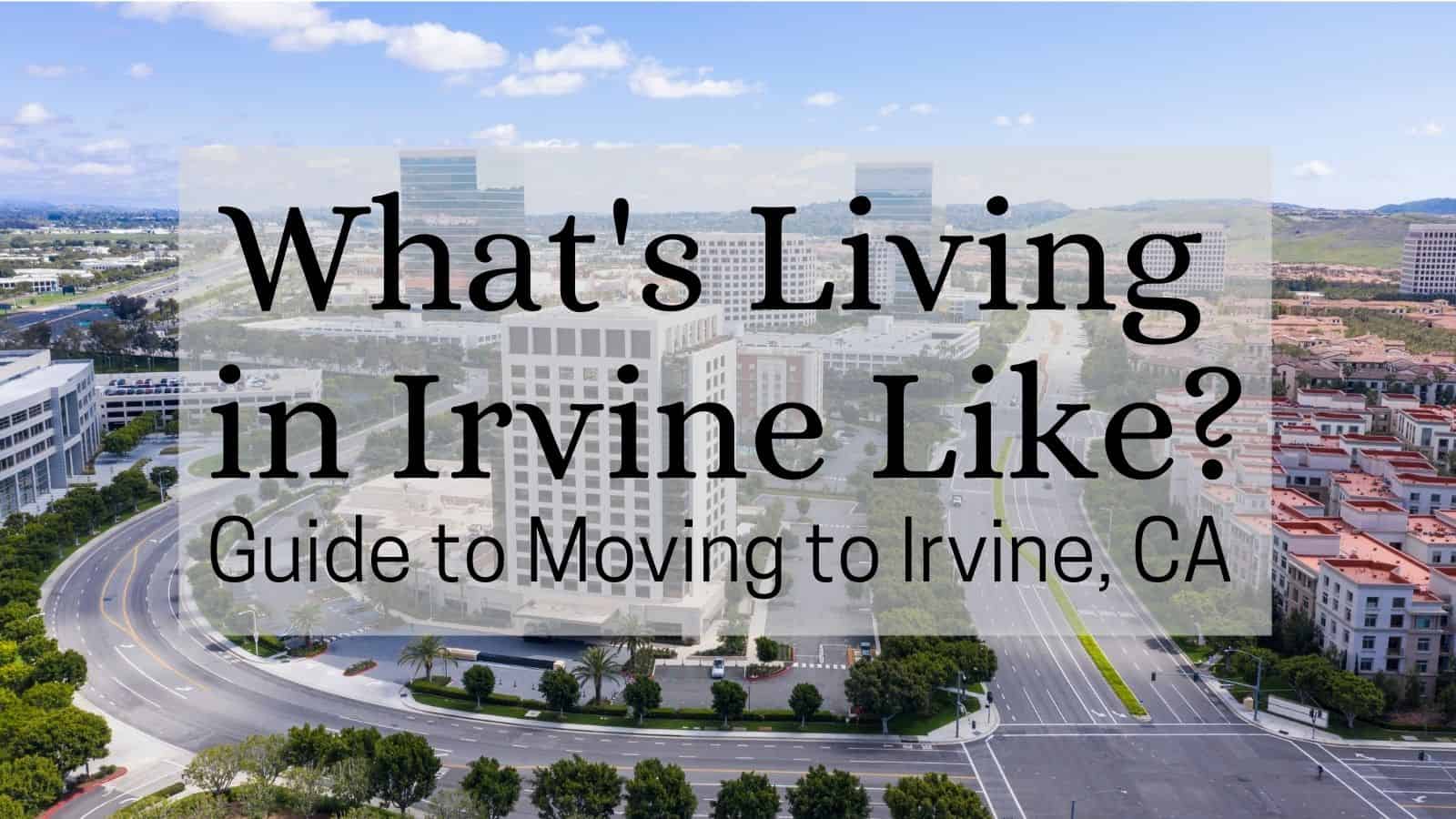

What S Living In Irvine Like Is Moving To Irvine Ca A Good Idea

Understanding California S Property Taxes

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register